well zuck is gonna be pissed it wasn’t him…

Don’t worry, I’m sure Facebook’s data is in that database as well

You could call it a ‘Masterbase’.

Always relevant:

Hey Iran, if you’re listening, and you’re looking for a soft target to add to your retaliation list for the recent attack…well while you probably can’t break into the White House, something tells me Palantir’s offices are a lot less heavily defended…They also do a lot of intelligence work, so they’re a valid military target.

So basically the Americans get Chinese-Style authoritarianism, but without the prosperity

yeah all the worst parts without any of the benefits, like education or healthcare

Competition for places in universities and even good doctors in China is crazy, or so I’ve heard. In general it’s a “dog eat dog” society much more than the US one, despite common misconceptions about both.

I dunno what “prosperity” they mean, the ability to actually start and finish projects is spectacular for China, yes. That’s why western nations are trying to hurt Chinese logistics, attacking their sources of raw materials, markets and routes. But the average Chinese man does not yet have an easier life than the average US-American.

I am originally from the States but moved to Australia.

Before I moved away I lived in a bible belt state that was one of the 18 US states that have a “tipped minimum wage” of $2.13 an hour. In those states if you have a job that earns tips you get paid $2.13 an hour, and your employer is supposed to match that wage to the federal minimum wage of $7.25 an hour.

However you can imagine if you are one of the lucky ones who has a job in the only restaurant in town, that asking your boss for those missing wages after a slow night is not going to get you anything but fired. There are dozens of other desperate people willing to take your place in a heartbeat.

I find a lot of people aren’t aware of the situation for large swathes of the US. The amount of people who are homeless or hungry or sick with no help is astronomical for a “first world country”.

What I find interesting is that after a cursory google search it would appear that China indeed has minimum wages, and those are interestingly not far off that $2.13 an hour.

https://www.china-briefing.com/news/minimum-wages-china/

The lowest hourly minimum wage in a province I could find was 16.5 RMB which works out to $2.30 an hour.

Now there are of course nuances here, like those jobs in China not being tipped, the cost of living, healthcare, etc.

I do think that things in the States are becoming more dire than most realise, and things in China have been steadily getting better.

In any case I feel very privileged to live in Australia and raise my children here.

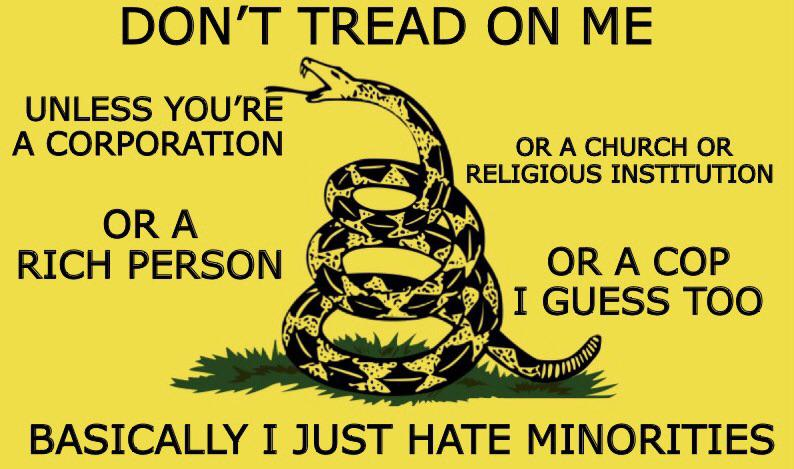

Brought to you by the party of:

- small government

- personal freedoms

- states’ rights

- less spending

- free speech

- religious liberty

Don’t bother. Hypocrisy is the gas, and cognitive dissonance the oil that power Conservatism.

yeah the Nazi shit snuck into this meme with the “kosher tier” shit on the text of the phone is gonna be a no from me dogg. Israel loves antisemitism actually. It would be a good idea to actually fight antisemitism and help Jewish people everywhere feel safe so they don’t buy into Israeli BS telling them they’re only safe there.

Huh?

it’s okay guys! The NRA said they were here to prevent this sort of thing!

We’re in goooood hands!

Isn’t that what credit score already is?

Just expand that, maybe with generative AI since the accuracy doesn’t matter.

/s

Not really, a credit score is based on your ability to repay loans.

How do you know that? The algo is proprietary, anything can go into it

The minutia of the algorithm is private, to prevent gaming it, but the major factors are very well known, and make perfect sense.

- utilization percentage (if you’re maxing out your credit line(s) all the time, that’s a bad sign)

- payment history (if you don’t make payments by the due date consistently, that’s obviously an indicator that you’re risky to lend to)

- age of account(s) (having made consistent payments for 6 months naturally isn’t going to look as good as having done so for 5 years)

Also if you repay your loan early is somehow bad for your credit score.

If you change your bank to go to a cheaper one alters your score (creating sticky monopolies).

makes prefect sense

To scam citizens out of yields while minimising the chance of nonperforming loans?

The rest of the world puts citizens first.

The banks are the professionals with all the data & capital. They get to multiplicate money (give loans without backing) and get to charge relatively big interests on those loans (interes rates (spreads over risk-free) tnot indicative of/to cover the expenses of defaults, which are very rare overall, or their own operating costs).The money multiplication thing comes from the state (central bank), and it exists to allow people to live & to perpetually stimulate the economy (eg getting a house earlier than saving up the lump sum to buy it whole). The banks job is to balance things out & offer competitive loans in terms of profits vs probability of defaults. Without that it’s just free money for the banks. Like insurance business only selling policies to people/entities that won’t ever need them.

Also if you repay your loan early is somehow bad for your credit score.

- The tradeline doesn’t disappear from your credit report when you pay it off. It continues to benefit your average age of accounts for up to ten years (note that credit score estimates like Credit Karma do not work this way, and stop considering the loan the instant it’s closed, which is not the way it works at the three credit bureaus—more info on the differences between Credit Karma’s system and your actual credit score here).

- It’s trivial to have and maintain a good credit score with a revolving credit line (e.g. credit card) you’re using and paying every month; installment loans are temporary by definition, and considering that loans with 0% interest essentially don’t exist, they are not the way to go about building your credit score; they’re what you use your good credit score to get as good a rate as possible.

With regular credit card use only, my credit score is well over 750 (and 750+ is top-tier from the perspective of basically 100% of lenders). And the last installment loan I had (car purchase over a decade ago), I coincidentally DID pay off early. Also, my average credit age, just checked, is 7y 9mo, less than the ten years mentioned above.

To scam citizens out of yields while minimising the chance of nonperforming loans?

Credit scores can only benefit good borrowers. Without them, everyone gets treated the same as people who have never borrowed, and lenders are obviously going to err on the side of caution (read: higher interest rates) when lending to someone who’s a big question mark. But with credit scores, lenders can know who the ones who do make their payments regularly are, in other words, who it’s least risky to lend to, which leads to lower interest rates.

In short, without credit scores, everyone gets shitty rates. With them, only shitty borrowers get shitty rates.

To reiterate, the bottom line is that you don’t need to pay a single penny of interest to have a superb credit score. Just use a credit card and don’t borrow more than you can pay off every month, same way you’d be limited if you were spending cash on the spot each time. That’s literally all it takes.

Ngl & sorry but that sounds indoctrinated af.

7~10 years on a car is predatory & shouldn’t even be allowed. You overpaid half the car.

Difference between high & low(er) interest rates is access to credit & purchasing power. It determines what/where or even if you can buy a house. There are even USA pop culture reference to not having a good enough score so they don’t get a loan.

And y’all interest rates are still high, regardless of the score.

Forced use credit cards takes away money from the stores & you get almost nothing in return (you should get money back, not some weird promise on loan rates that saves you money only bcs of ridiculous rates & long borrowing).

And repaying credit card (interest or not) has 0 relation to repaying a 10+ year mortgage. It’s just bs to get the banks (and Visa/MC) obscene amounts of free revenue/profit & they don’t have to do anything in return. Just think of how much money have “you” given the bank if 3% of all your purchases went to them. It’s not that you directly lost that (tho through general inflation & stores overcharging you to cover what goes to the bank you have), but didn’t get anything for selling/promoting their product either.Different counties over the world use different systems, but most don’t allow centralised private databases (tho some big ones still use it) that lenders can just access personal data on citizens (and all of them have problems).

Some countries have defaults or unpaid taxes accessible to lenders (via gov agencies/portals, not private firms).Tho the best systems are just every lender for themselves & on data you provide them - statistics show how rare defaults are & how they don’t really affect any lenders (except in a macroeconomic crisis, where eg the underlying real estate losses value).

And statistics also show that the prob of default are basically just related to wages (how much money is left to the borrower each month overall) & collateral.

That’s is what central banks put restrictions on to govern monetary policy (besides overnight rates & gov debt ofc) & banking sector stability.And in terms of eg mortgages - credit score is useless, you have real estate value that more than covers the lean & just about any borrower would have a lot more problems & to lose in event of default so they already try to avoid it as much as they can.

Credit scores don’t lower bank insolvency rates, at most they help with the profit, but most importantly they arent really relevant to a lenders core business success.

Reread what I wrote, I didn’t have a protracted auto loan. I actually paid the car off a few months after I financed it, because I didn’t want to pay any more interest (even at 0.9%) and I could afford it. I don’t even remember what the original term was.